Gold vs US Treasuries -Central Bank Reserves Crossover - Should you be Worried?

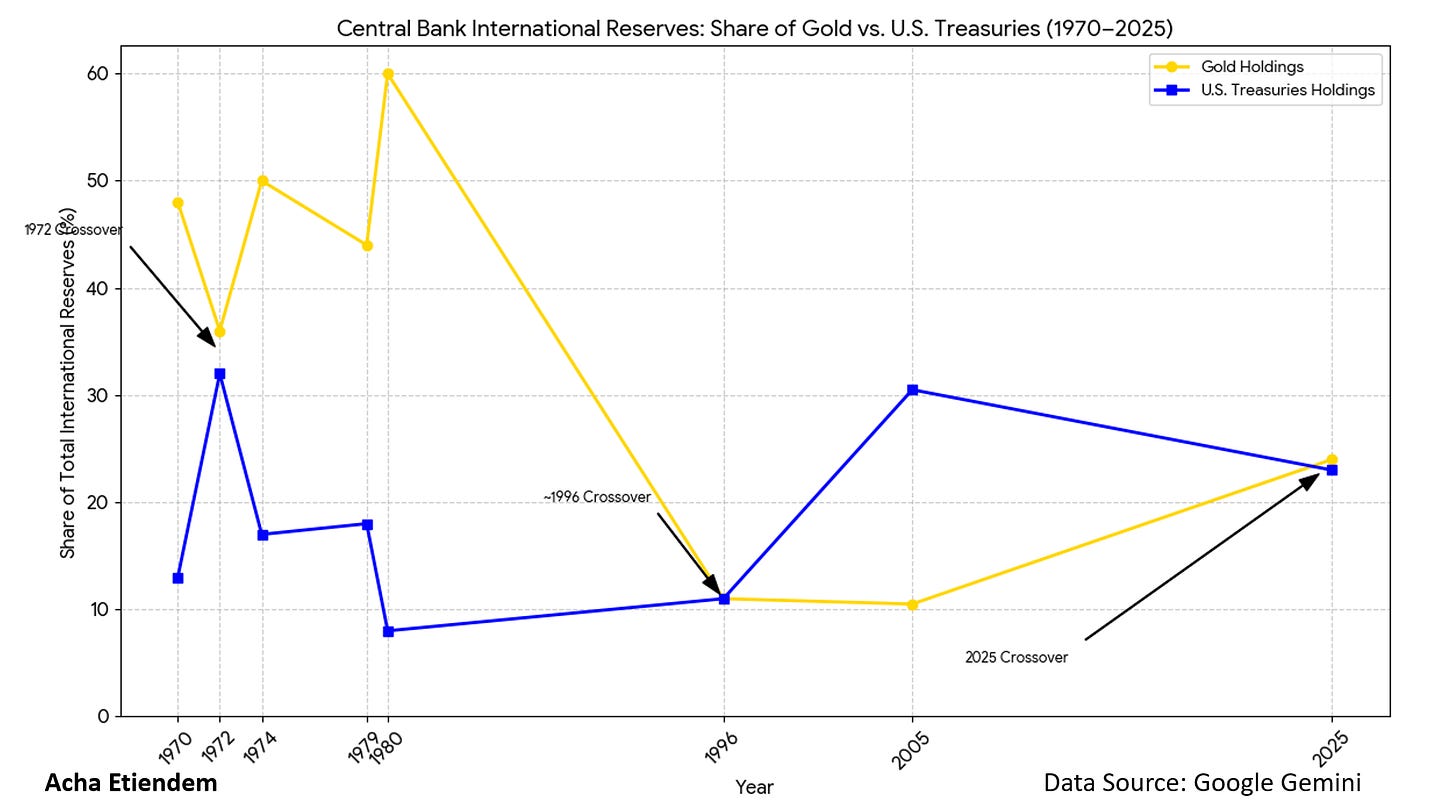

Have you found yourself wondering what all this talk about central banks holding more gold reserves than US treasuries means? Well, you’re not alone. I did a little digging and just thought I would share what I found. Like Ray Dalio, I had to look back in history for periods when this has happened before. And for that, we would look at the 1970s (Post Bretton Woods) and the 1990s (Pre-1996s Crossover). If seeing is believing, then let’s see this chart.

Figure 1. Gold vs U.S. Treasuries historical crossover

I may have referenced Google Gemini as a data source, but rest assured, the data comes from a variety of sources such as reuters.com, fxstreet.com, etc. I just couldn’t claim the credits to be honest.

1970s: So, back in the 1970s, we had a gold rush when the US ceased the convertibility of dollars into gold. What happened was a spike in inflation to as high as 13.5% as many flocked to gold as a hedge against inflation. This was not the only reason for gold accumulation by central banks, as we also had oil shocks and geopolitical turmoil (the Yom Kippur War). Central banks ramped up gold purchases as they hedged against the dollar. What happened was that a +2300% peak in gold by 1980, with gold going from $35/oz to $850/oz. Here’s what happened: the US Federal Reserve raised interest rates to fight inflation, leading to attractive real yields. Investors love profits/yield, as has been historically proven. With gold just being a shiny metal without yield, investors eventually saw the opportunity cost of holding non-yielding gold and thus began reverting to US treasuries. I personally believe this period brought about the possibly now-outdated 60/40 portfolio.

1990s: By the 1980s, debt crises in Latin America were going to shake the system, and European banks were anticipating the birth of the Euro, leading to massive gold hoarding. Gold briefly overtook US treasuries by 15% - 20% in 1996. The 1990s had 1996 as the crossover year.

Hello! hello! 2025: Gold has put on nine consecutive weeks of gains, leading to a crossover yet again. Factors such as interest rate cuts, US sovereign debt concerns, Trump policy tariffs/policy uncertainty, and, US sanction-proof status of gold have all been the reasons for gold’s rapid spike. When gold has gone up like this, many have echoed fears about the unknown. What we don’t know is what we don’t know, and as 2025 draws to a close, we will have to see where this all leads.

Summary: There isn’t a clear pattern among these crossovers, but what I saw was that gold tends to lose value when other assets start to yield better returns. 2025 is closer in similarity to 1971 than 1996. However, we are seeing longer-term foundations being laid in 2025, unlike 1971 and 1996. This is because we have emerging markets hedging for real now, cryptocurrencies distorting traditional variables, and the fact that this gold rally has been more in price action than volume. Furthermore, US treasuries haven’t seen any real relative selloff, which shifts the focus away from the de-dollarization or debasement issue.

Stocks (S&P 500): In the 1970s, we saw stagflation lead to a stock market downturn, but for the period 1971-1980, the S&P returned an annual average return of +10.95%. In 1996, we had an annualized average return of +22.96% and of course, we all see where the stock market is trading at the moment (2025), making record highs. All I can conclude is, we can continue to expect growth in markets as a result of productivity. So it continues to make sense to keep investing gradually(dollar cost averaging) as history shows. Gold-US treasuries cross-over is another talking point, and this time, it makes perfect sense to have gold in portfolios.

What do you think? Leave your comments and criticisms

Comments

Post a Comment